carried interest tax proposal

11 hours agoWhile Senate Democrats estimate the plan to tax carried interest as regular income will only generate 14 billion the bill has a 739 billion price tag. West Virginia Sen.

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

Tax increase on carried-interest income could potentially hurt small businesses and big investors such as endowments foundations and pension funds.

. Carried interest refers to a longstanding Wall Street tax break that let many. 22 hours agoThe carried-interest tax hike is part of the Democrats broad proposals to increase taxes on corporations and wealthy individuals to finance new spending on. Carried interest offers lower tax rate than for income Biden administration had proposed eliminating the tax break House Democrats Tax Plan Includes 265 Top Corporate Rate.

Tax increase on carried-interest income could potentially hurt small businesses and big investors such as endowments foundations and pension funds. A new proposal to tax carried interest as ordinary income was just attached to a larger tax and spending bill that could be voted on by. 23 hours agoVenture investors shrug at proposed changes to US carried interest taxation.

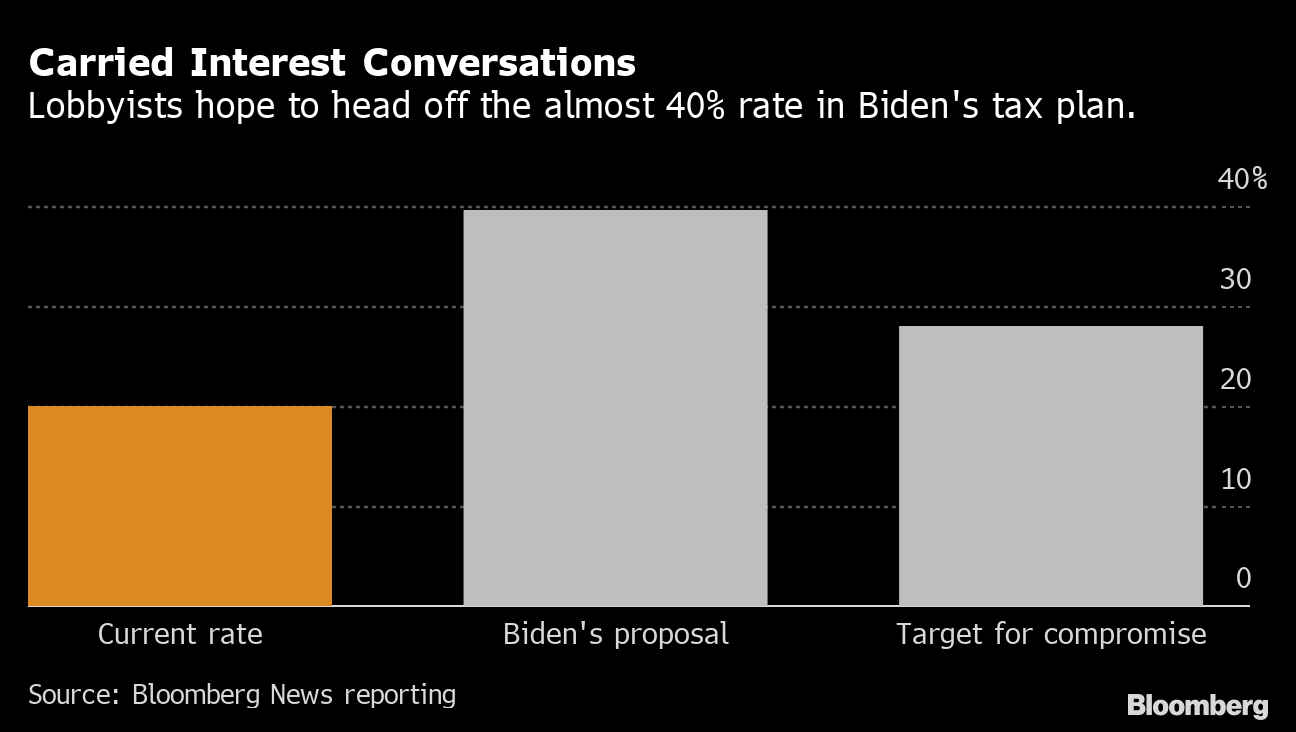

20 hours agoNEW YORK July 28 Reuters - Private equity and hedge funds cautioned on Thursday that a proposed US. Closing the carried interest loophole is likely to be one of the thorniest sticking points in moving the Inflation Reduction Act of 2022 forward. Jul 29 2022.

Most notably the legislative proposal would levy a 15 minimum tax. Joe Manchin D-WV the swing vote on many legislative initiatives in the evenly divided Senate announced on Wednesday his support for a suite of changes to the tax code as. Some view this tax preference as an unfair market-distorting loophole.

The Democrats latest plan to hike taxes on carried interest a form of income earned by private equity funds that is subject to a lower tax. 21 hours agoBut the carried interest rule wouldnt bring in the most revenue of the tax proposals included in the Inflation Reduction Act. The carried-interest tax hike is part of the Democrats broad proposals to increase taxes on corporations and wealthy individuals to finance new spending on energy electric vehicle tax credits and health insurance investments.

Editing by Marguerita Choy. Maryland proposes tax on carry management fees. A compromise in Congress is forming among Democrats to tinker with the tax code generate revenue by other means and.

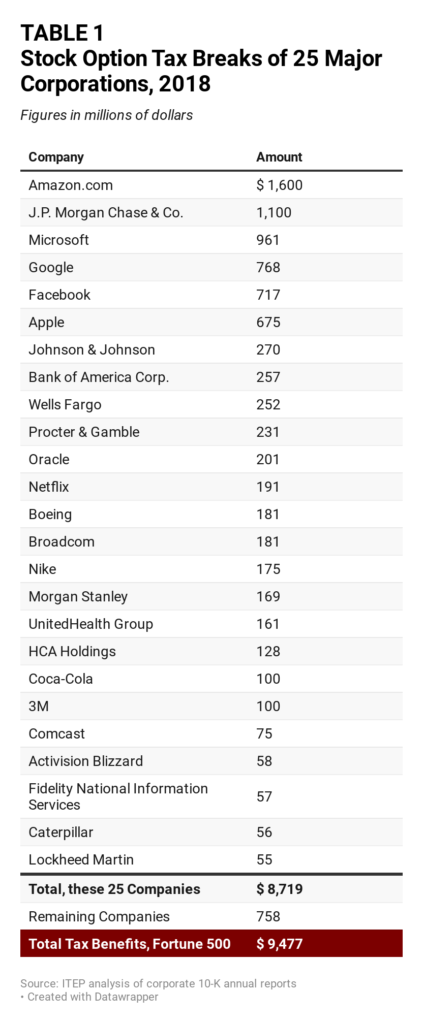

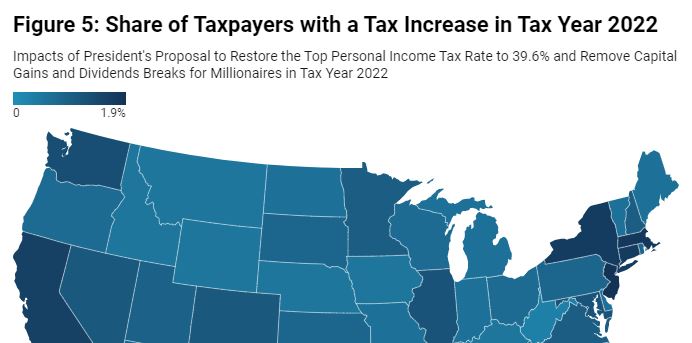

20 hours agoIn the first months of his presidency Biden proposed a sweeping list of tax increases that would kick in for individuals earning at least 400000 a. Tax increase on carried-interest income could potentially hurt small businesses and big. At most private equity firms and hedge funds the share of profits paid to managers is about 20 percent.

20 hours agoT he Democrats latest plan to hike taxes on carried interest a form of income earned by private equity funds that is subject to a lower tax rate doesnt go as far as liberals had hoped. Reporting by Carolina Mandl Chibuike Oguh and David Randall in New York. At most private equity firms and hedge funds the share of.

Unlike previous proposals in other states even funds located outside the state would be hit by the tax if they invest in Maryland businesses. Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation. 23 hours agoCarried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation.

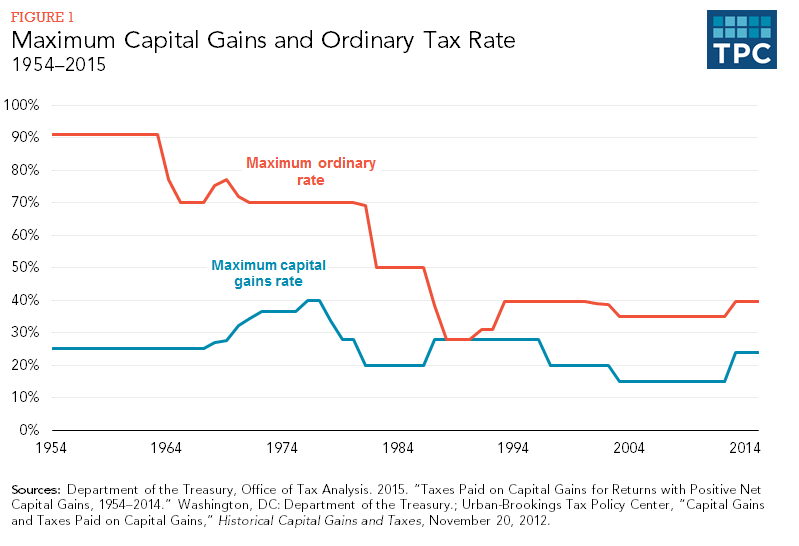

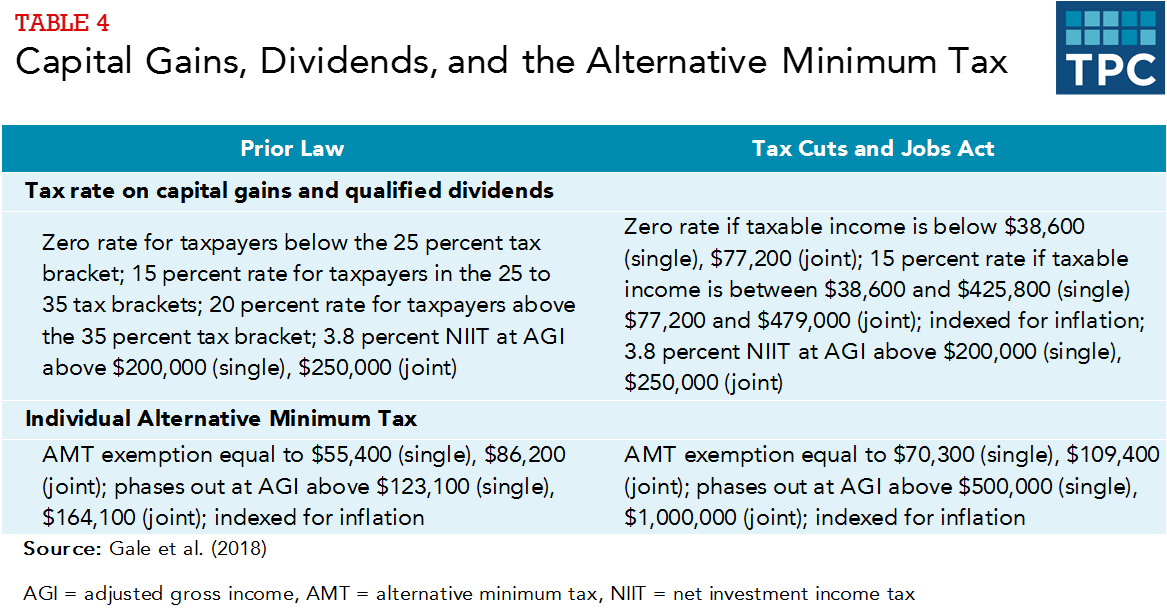

Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation. NEW YORK Reuters Private equity and hedge funds cautioned on Thursday that a proposed US. Under existing law that money is taxed at a capital gains rate of 20 percent for top earners.

The Biden administrations proposal to tax carried interest at a higher rate like the ill-fated proposal from the Trump administration. Joe Manchin D said Thursday he is standing firm on keeping a proposal to close the so-called carried interest tax loophole in the tax and climate deal he reached this week. NEW YORK Reuters Private equity and hedge funds cautioned on Thursday that a proposed US.

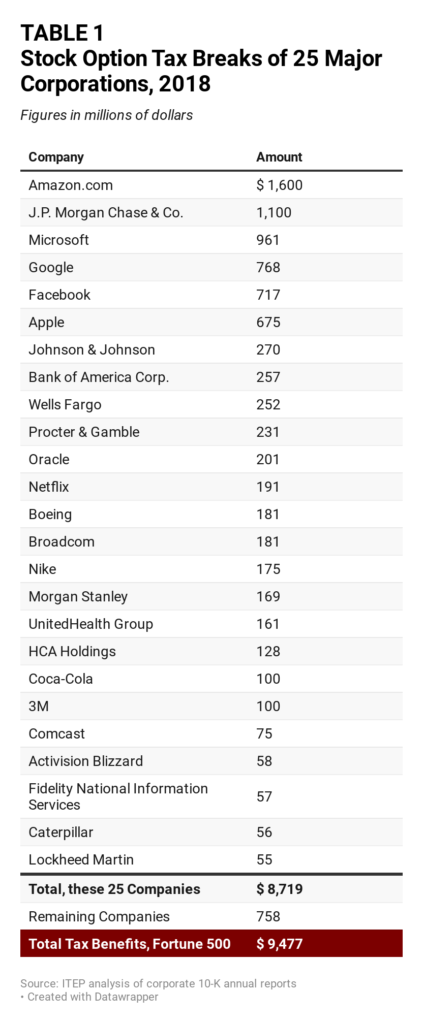

Several Republicans denounced the current proposal. Marylands House and Senate proposed legislation to apply a 17 percent additional state income tax to carried interest and management fees. 3 hours agoTransfers of carried interest would be subject to tax at short-term capital gain rates even if a non-recognition provision would otherwise.

Others argue that it is consistent with the tax treatment of other entrepreneurial income.

House Ways And Means Committee Tax Proposal

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Biden Aims At Top 0 3 With Bid To Tax Capital Like Wages Bloomberg

Summary Of Fy 2022 Tax Proposals By The Biden Administration

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

A New Era For Carried Interest In Hong Kong Kpmg China

Income Tax Increases In The President S American Families Plan Itep

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

.jpg.aspx)

Will Congress Close The Carried Interest Loophole Bdo

Pwc Cn Publication New Year Good News Carried Interest Tax Concession

Carried Interest Plans Can Benefit Both The Fund Management Industry And Investors Intertrust Group